GREGORY ABRAMS DAVIDSON SOLICITORS

You’ll want us on your side

Relief for the Property Industry!

The property industry has welcomed the latest government announcement; from 8th July 2020 any main residence purchase completion will benefit from stamp duty relief. The stamp duty holiday applies to residential property purchases of up to £500,000 and is granted for a limited period for all purchases completed on or before 31 March 2021.

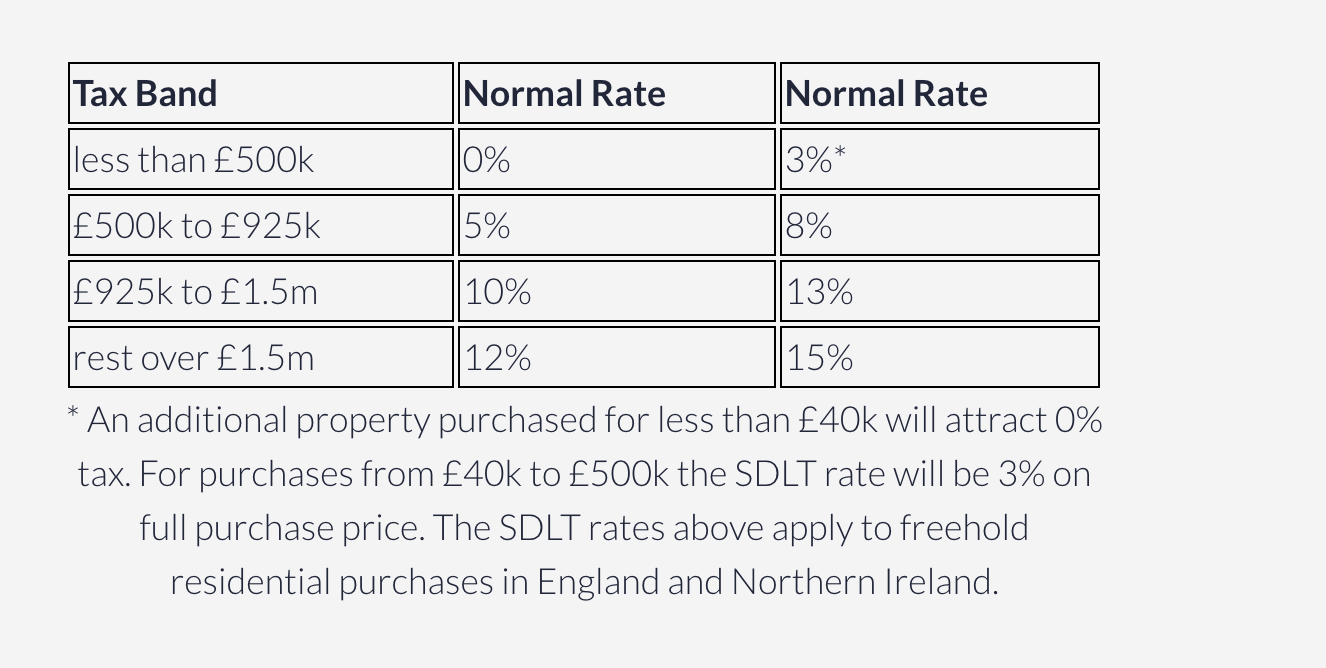

Buyers should be aware that this relief will not apply to properties that fall within the mixed use category. The holiday only applies to purchases from the 8th July which means that any completions that have happened before that date will have to pay the normal stamp duty amount. For clarity about the tax bands please see the table below which illustrates the new stamp duty rates.

* An additional property purchased for less than £40k will attract 0% tax. For purchases from £40k to £500k the SDLT rate will be 3% on full purchase price. The SDLT rates above apply to freehold residential purchases in England and Northern Ireland.